YOU FINANCE EVERYTHING YOU BUY…..

What comes to mind when you read the above statement? You are probably thinking to yourself, no I don’t!

Possibly you recently paid cash for your kitchen remodel or that new bed room furniture set you had been eyeing for some time. Did you make a choice to pay cash for your new car or maybe it was a new washer and dryer set?

When it comes to Self-employed business owners, there’s no doubt that they routinely pay cash for their major capital purchases within their business.

Regardless of the business or personal item you decided to pay cash for, you thought it was a wise decision. The bottom line is that if you paid cash, you made a choice to use your money instead of someone else’s money (borrowing to make your purchase). Paying cash for life’s big ticket items ostensibly is a wise financial choice.

If what you thought to be true about your money turned out not to be true, when would you want to know about it?

The way you spend your money is as equally important as the act of actually saving your money.

Neither Wall Street nor the Government wants an informed public. Your best defense is an informed mind. If you are serous about your money, it’s imperative that you be committed to self education and being aware of what is actually going on. Understanding our current monetary system, banking and economics will serve you and your business well in these less than certain economic times. You will want to seek out someone who is passionate about helping you learn these fundamental truths about how your money works.

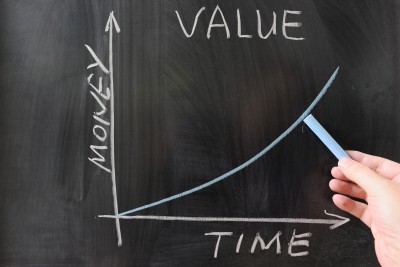

Have you noticed that you always give up something when you make choices? In every financial decision, you sacrifice something to obtain something else that you consider more desirable. For example, you might forgo current buying to invest funds for future purchases. Or you might gain the use of an expensive item now by making credit payments from future earnings. You are constantly making choices among various financial decisions. In making those choices, you must consider the time value of money, the increases in an amount of money as a result of interest earned.

Saving or investing a dollar instead of spending it today results in a future amount greater than a dollar. Every time you spend, save, invest, or borrow money, you should consider the time value of that money as an opportunity cost. Spending money from your savings means future lost interest earnings or lost opportunity cost. Failing to learn the lessons of lost opportunity cost and the time value of money is a serious impediment to growing your wealth.

Saving or investing a dollar instead of spending it today results in a future amount greater than a dollar. Every time you spend, save, invest, or borrow money, you should consider the time value of that money as an opportunity cost. Spending money from your savings means future lost interest earnings or lost opportunity cost. Failing to learn the lessons of lost opportunity cost and the time value of money is a serious impediment to growing your wealth.

You finance everything you buy. You either earn interest, or you give up the ability to earn interest. If You give up a dollar today, it not only cost you that dollar, but what that dollar could have earned had you been able to keep it.

In order to avoid interest lost and it’s opportunity cost, you must understand the rules. Do the financial institutions teach you the rules? No! Unfortunately, until you understand the rules, you can end up loosing hundreds of thousands of dollars unknowingly and unnecessarily. It’s not our job to play the game for you, but to teach you the rules. It’s about a process, not a specific financial product.

The “Saver” or the person that pays cash for most everything is a borrower. They borrow from themselves and then makes payments back to themselves to get back to where they were before they made their purchase, thereby giving up the interest their money would have earned. They reset compounding interest, which has a devastating affect to their long term wealth accumulation. I know plenty of people that borrow from their own savings to pay themselves back the money they took out of their account. How many of these “savers” do you think paid themselves back all the interest they lost while the money was out of their account?

True wealth creators understand the principals of banking and economics. Wealth creators understand the rules. They understand how to use other people’s money to maximize the efficiency of their money. They know the power of accumulating an increasing pool of money that provides them accessibility, control and uninterrupted compounding interest.

So what are we saying? Seek to put yourself in control of your money. You must maintain liquidity use and control of your money all the while earning uninterrupted compounding interest. It is this simple, you are either going to operate and think like a bank, or you will be a customer of the bank. When you truly understand the rules, you will only then begin maximizing the efficiency of your money.

Remember, it’s not your rate of return or where you money is that matters, but rather, how your money works. Feel free to call me anytime to allow me to share how to implement these powerful strategies in your business, or your personal life. It will fundamentally change the way you think about your money.

I can be reached at 501-952-3090

Until Next Post……..

David Lukas