This week, David reads an excerpt from his upcoming Book, “Whose Future Are You Financing? What the Government and Wall Street Don’t want you to know.” The excepts relate to the “Mega Banks”. Those that are too big to fail. Just 12 banks Control 70% of all banking assets. These are the same banks that continue to receive tax-payer subsidies.

David talks about Mutually Held Dividend Paying Life Insurance companies. The year that ten thousand banks failed it was found that 99.9% of funds deposited with life-insurance companies were found to be safe. In fact, it was the insurance companies, NOT The government, who helped the banks stabilize at that time.

David talks about Mutually Held Dividend Paying Life Insurance companies. The year that ten thousand banks failed it was found that 99.9% of funds deposited with life-insurance companies were found to be safe. In fact, it was the insurance companies, NOT The government, who helped the banks stabilize at that time.

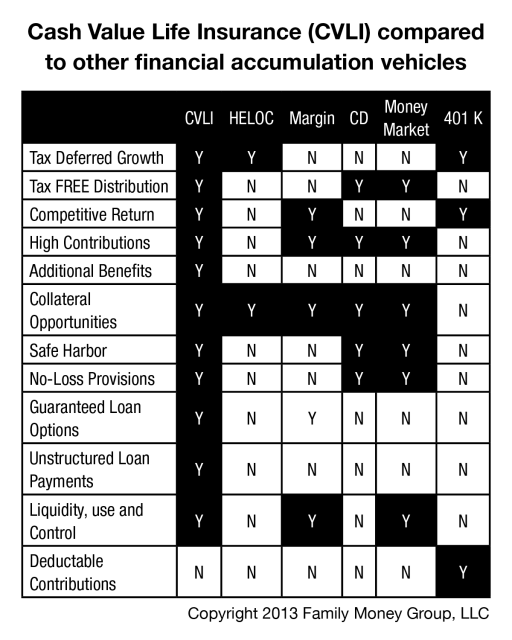

David talks about an asset class that has been in existence for well over 150 years. Wall Street and the media have convinced millions of people that you would be a fool to send a dollar to a life insurance company to allow them to invest it for you. Yet the facts reveal the truth is something all together very different.

Many people do not know that banks own billions of dollars of cash value life insurance. In fact, up to 25% of tier-one capital assets (A banks safest investment)

reside in BOLI’s (Bank Owned Life Insurance). At the turn of the century, approximately 50% of American’s discretionary savings were held with life insurance companies.

Tune in to find out what is a non-direct recognition company VS. a direct-recognition life insurance company?

There are two primary reasons why so many Americans are not aware of the immense living benefits that a cash value policy can provide you.

1. Commissions. A properly structured cash value life insurance policy that emphasizes cash accumulation

and living benefits directly reduces commissions paid to a life insurance agent by 60% or more. It’s a sad, but

true, reality. In the sales world, incentive drives behavior. This is one reason many consumers are not

aware such a powerful financial tool exists.

2. Wall Street, and the major financiers of the financial media want you to be convinced that you would be a fool if you ever send a dollar to a life insurance company to allow them to invest it for you. (Every dollar that goes to an insurance company does not go to Wall Street). Unfortunately many advisers have been conditioned to tell you to “buy term and invest the rest.” It also may very well be that they simply do not understand how to properly structure a high cash value policy to help you maximize the living benefits while retaining the death benefit. There is a behind-the-scenes battle that has been taking place for some time.

Tune into to hear David talk about this little understood asset class.

You can reach David anytime by calling 501-218-8880 or email: David@DLShowOnline.com