What is opportunity cost? Simply stated, if you have a dollar today and you transfer it to someone else, not only did you lose that dollar, but also what that dollar could have earned you over time had you not given it away. Opportunity cost has been given little to no attention in retirement planning circles. This is unfortunate because it’s a real thing that can cost you dearly. It is crucial that you understand opportunity cost. Once you do, it will totally transform the way you handle your major capital purchases.

The way you spend your money is as equally important as the act of actually saving your money. Now that you know about opportunity cost, you need to know that you finance everything in life that you buy. You either pay interest, or you give up the ability to earn interest. It’s just that simple. There is a cost no matter how you choose to buy your next car. If you finance the car by borrowing money from someone else, you pay interest to that financial institution for the right to use their money; however, if you pay cash for the car, it is true that you avoided paying any interest; however, you also gave up the ability to earn interest on that money in the future.

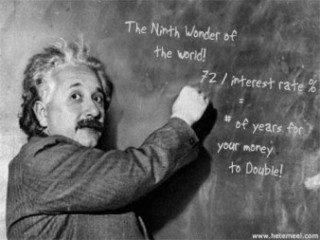

Albert Einstein said that compounding interest is the eighth wonder of the world, he who understands it, earns it. He who doesn’t, pays it.

Once you understand the power of compounding interest, you will conclude that it truly is a miracle! Compounding interest works best, uninterrupted and over time.

Once you understand the power of compounding interest, you will conclude that it truly is a miracle! Compounding interest works best, uninterrupted and over time.

Spending your money essentially resets the compounding cycle, which in turn will have a dramatic effect on your ability to build long term wealth. The primary reason that the majority of people fail to save anything substantial is that they have no plan to spend their money during the compounding years. You see, if you spend your money, it stops compounding and the miracle stops! The key is to have complete liquidity use and control of your money, while at the same time your savings NEVER stop compounding. Unfortunately, the “Qualified” plans that the government and many advisers recommend for savings and retirement do not give you access to your money without you being subject to taxes and penalties. SEE: Who’s Future Are You Financing?

To really drive home lost opportunity in relation to the power of compounding interest, let us look at the following example:

Suppose you have decided to make a major capital purchase. Let’s assume it is $6,000 worth of furniture for your home. Since you now understand that everything in life is financed, a question now must be asked. What is what is the most efficient way to go about this purchase to minimize any unnecessary wealth transfers?

The majority of Americans would finance the purchase with the retailer who is selling the furniture, we will call this individual the spender. Of course the alternative would be to save up the $6,000 and pay cash. We will call this person the saver. The spender already has little to no savings and they typically pay interest for all of their major purchases. The only thing that the spender has is the income from their job, so they pledge a portion of their future earnings to make the purchase.

Not only does the spender loose the interest they are paying, but they also loose what that money could have earned them had they been able to keep it and let it continue to compound. The spender is in a constant cycle of paying interest as well as repaying the principal amount they borrowed. For the spender, this is a cycle that repeats itself over and over.

The saver on the other hand understands the high cost of transferring interest away to finance a purchase such as this, so the saver reasons the best course to take is to pay cash for their purchase thereby avoiding paying all of that interest. What the saver fails to consider is that since they paid cash, they can no longer let that $6,000 compound. Over a lifetime, it can represent a substantial amount of money. Assuming the saver could have averaged a return of 6.1% over 30-years, that six-thousand dollar “cash” purchase represents a loss of $31,230 in what that six thousand could have earned! So yes the saver avoided paying any interest, but they also potentially lost out on $31,230 plus they would still have their six thousand dollars.

While the saver is in a much better financial position than the spender, both have failed to understand lost opportunity cost.

You might now be thinking then what is the answer? Is there a better way? The answer is yes. Once you learn about the efficiency of money, you will learn how to make your one dollar earn ten, instead of what Wall Street has taught us which is to make ten dollars earn one.