To be American is to spend money—right? Unfortunately, for the most part, that statement is correct. In today’s financial environment, many savers are finding the pressures to conform their saver’s mentality to that of a spender’s hard to withstand.

So what’s a saver concerned with financial security trapped within a consumer culture to do?

So what’s a saver concerned with financial security trapped within a consumer culture to do?

In this week’s installment of the David Lukas Show, David and Zach explain steps that can be taken and the planning that should be done to ensure a WorryFree Retirement™.

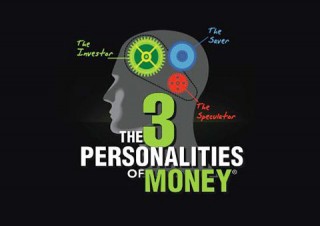

First on the discussion table is Hersh Shefrin’s, PHD, study “Born To Spend”, and how both nature and nurture impact an individual’s spending and borrowing habits. David and Zach explain, in detail, why a person’s mentality towards money matters and how the traditional approach to financial literacy and understanding isn’t working for most Americans. One major reason being that most of us don’t know what our financial personality is. Knowing how you think about money is a key component to gaining the skills and understanding the processes that are involved in making informed investment decisions.

Find out what your financial personality is today!

today!

Of course, financial security takes more than just a basic knowledge of all the options that savers, investors, and speculators alike have for safeguarding their hard earned retirement funds. It takes a firm vested in your future, a firm like David Lukas Financial, to set said safeguards in place.

David Lukas Financial specializes in the uncommon strategies that can protect your hard earned money and retirement funds from the inevitable pitfalls of Wall Street. If you’re interested in Sleep Insurance™ and worrying less about money™, call 1-800-559-0933 now.