The following blog post is from the book: “Whose Future Are You Financing? What The Government and Wall Street Don’t Want You To Know.”

Albert Einstein said that compound interest is the 8th wonder of the world. It works best uninterrupted and over time. When money is put aside and left untouched

to collect interest year after year, the result is nearly miraculous.

The reason compounding interest doesn’t work for so many Americans is they fail to save any substantial amount of money during their lifetime because they have no method to gain use and control of their money during the compounding period. If you spend the money you are supposed to be saving, you interrupt the compounding process and “kill the miracle” that makes compound interest work.

And what’s the secret to this miracle?

You NEVER Touch the Principal.

This allows the interest to compound continually (upon itself and the principal) so that you earn increasing amounts of growth as the years go by.

For Example: If you put just $100 a month away for 40 years, compounding at 7%, your $48,000 has turned into $265,643! But the problem is…life happens.

There are all kinds of expenses that come up throughout your life—many you don’t anticipate, such as:

● You need a new air conditioning unit.

● You need a new roof.

● You lose your job.

● Your kids need braces.

● Your house floods.

The truth is that most people don’t have a plan (nor a method) to gain access to their money while still allowing it to compound uninterrupted. That is why most people fail to accumulate substantial savings during their life.

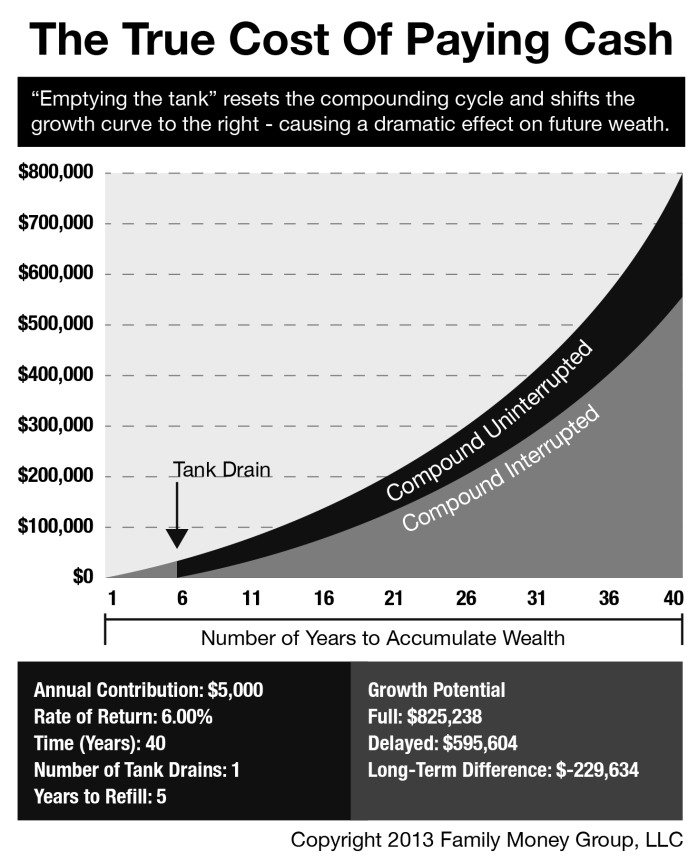

Remember: The “miracle” of compound interest works best uninterrupted and overtime. If you “kill” the miracle, it doesn’t work! If you were consistently saving $5,000 per year and you spent what you had saved in the 5thyear, it would represent a long term loss of $229,000 over your lifetime!

(See Figure 1.1 below)

That’s a HUGE loss. But this is precisely what most people do they remove their savings to make a purchase, thus “killing the miracle” of compound interest. Then, when they reach retirement, they don’t have nearly enough saved and are putting themselves at great risk of running out of money.

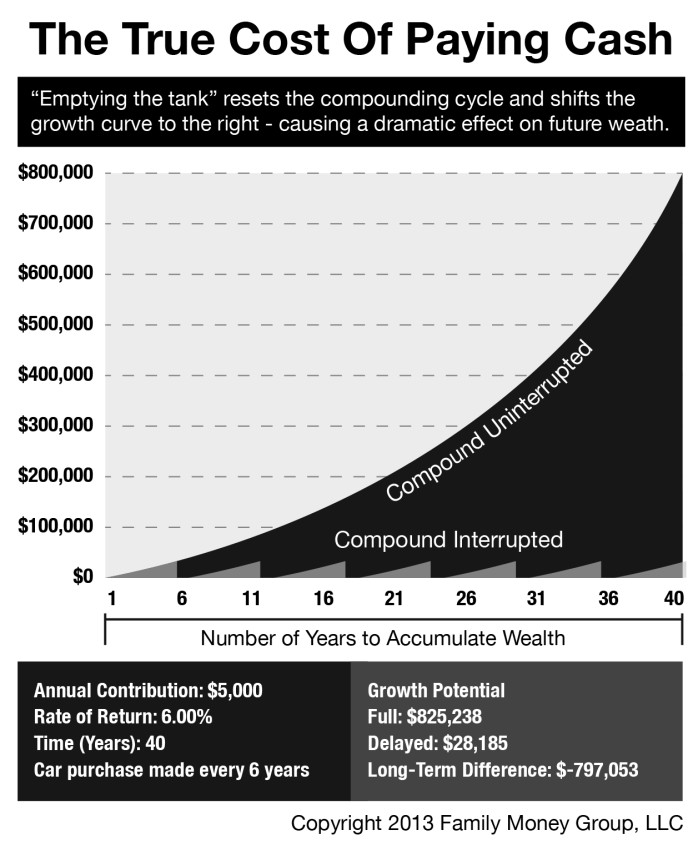

The example above assumes you only make one cash purchase in your lifetime. What about the person who pays cash for every automobile purchase? After all, isn’t “paying cash” what we are taught is the wise financial choice? If a household acquires just one vehicle every 6 years and paid cash for a total 7 cars over a 40-year time frame, this would represent a long-term loss of $797,053! (See Figure 1.2 below)

This is a conservative estimate as we assume that every car costs only what was accumulated before the savings were depleted ($34,877) every six years to make the auto purchase. Most likely the cost of transportation would increase over 40 years.

A better strategy is to allow your money to compound continually and have complete access to use it for purchases.

To continue reading, get your copy of “Whose Future Are You Financing? What The Government and Wall Street Don’t Want You To Know.” click on the book below:

The following blog post is from the book:

The following blog post is from the book: