Courtesy of our good friend Tony Walker at TonyWalkerFinancial.com

Mistake 2: Walking by Blind Faith

The date: October 9, 2007. The Dow is at an all-time high: 14,164. Frustrated with low CD rates, Joe Lunchbox (who considers himself conservative – a saver) is one unhappy camper. Over the years, ole’ Joe enjoyed decent interest rates from his FDIC bank products, but on this particular day, a chance encounter convinces Joe to change course by closing out his “safe stuff” and moving his $100,000 retirement account at the bank into a “diversified” portfolio of growth mutual funds.

Well, as the old saying goes: “What goes up must come down.”

And down Joe went… along with much of his life savings.

Frustrated by the quick drop, Joe goes over his only two options: “hang in there” and wait for the market to come back up; or secondly, get out of the market and take his losses. Since Joe doesn’t want to take his losses, he investigates how much the account will have to grow in order to get back to break even. To which the answer is, “Who knows?”

Let’s take a look…

Date of Investment: October 9, 2007 DOW at the time: 14,164 Amount invested: $100,000 Type account: Taxable mutual fund Tax bracket: 33% Assumed loss: 40%

As the chart illustrates, even if Joe’s growth mutual funds, which previously dropped by 40%, grow by 40% each year (which is highly unlikely), it still takes nearly three years (when you include the 40% loss, taxes and lost opportunity cost) of earning 40% per year to get back to his original principal of $100,000.

Repeat: Joe’s account would have to grow by over 40% PER YEAR, for nearly three years in a row, to get back to his original savings of $100,000. How discouraging is that?

Let’s summarize Joe’s blind walk of faith…

Joe loses all hope of retiring Worry Free. Joe loses a lot of sleep. Regardless of whether Joe makes money or not, Uncle Sam still gets his fair share (even though Joe lost money) via taxes on the account.

And while we’re talking about cattle calling (how to herd people and their money) let’s look at another tactic: “average rate of return” vs. “real rate of return.”

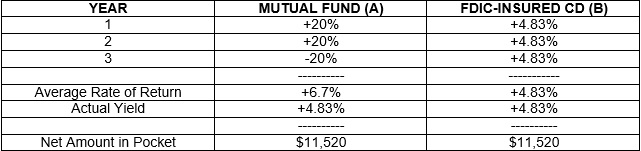

Column B shows $10,000 of Joe Lunchbox’s account at the bank compared to a proposed growth mutual fund (column A). Take note as to the “average return” of the past performance of this particular mutual fund at 6.7% (just an example). Now, take a look at the “actual” return of this fund: 4.83%. Not too impressive when you realize that it is the exact same return as the safe and secure CD with its interest rate of 4.83.

Now that’s very interesting… Joe would have just as much money had he left it in the safer pastures of his local bank.

Which pasture would you feel more comfortable grazing in? Only you can decide.

Talk to your financial advisor about all of your options. You’ll be glad you did… and will most likely worry less about your retirement as a result.

Want to learn more? Pick up a copy of Don’t Follow The Herd.