When something comes along that’s outside of your box of knowledge, you have two choices. You can ignore it, or you can get a bigger box!

When something comes along that’s outside of your box of knowledge, you have two choices. You can ignore it, or you can get a bigger box!

This week, David is joined by John Little in the studio.

David spends the majority of this episode talking about the importance of being efficient with your business operations.

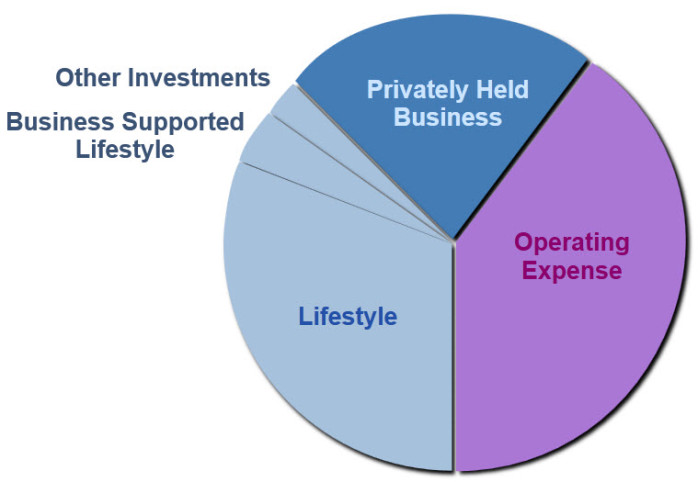

Many advisers have all kinds of ideas on where you should invest the money your business is generating . When it comes right down to it, the best place to invest your money is within your own company. This is simply because your business is something you have an intimate knowledge of and have a relative degree of control over. Any income your business generates is an investment return. There are more opportunities in focusing on the efficiency of your existing business cash flows than ever helping you pick better investment opportunities outside of your business.

What if you could loan your business “your personal savings” potentially earning a higher rate of return on those dollars while at the same time deducting the interest your business pays to use your money? This would enable you to be in a financial position to be the bank rather than a customer of the bank.

1.By being more efficient with existing cash flows your business can have guaranteed access to money for business expansion. You will have the ability to expand your business by 25 percent or more per year without ever calling a bank.

2. Any Guaranteed loans you decide to take advantage of is fully tax-deductible under current IRS rules.

2. Any Guaranteed loans you decide to take advantage of is fully tax-deductible under current IRS rules.

3. Any loans you take out have unstructured loan

4. The interest rates on any guaranteed loans you elect to take advantage of are set by Moody’s Bond Index.

5. Once you gain the knowledge of how banking, economics and the efficiency of money works, Your business can accumulate an increasing pool of capital, providing accessibility, control as well as uninterrupted compounding interest on your existing cash flows.

A dollar paid in taxes you could have avoided, not only cost you that dollar, but what that dollar could have earned you over the next 5, 10, 20 or even 30 years, this is what is known as lost opportunity cost.

These are the exact same strategies many large and well known corporations have put to work for decades.

If there are unnecessary expense losses your business is currently loosing that you could have avoided, when would you want to know about it?

Put to work the same concepts that large corporations have used for years. To learn more, you can reach David Lukas at 501-218-8880 Email David anytime at David@DavidLukasFinancial.com or online at: DavidLukasFinancial.com