For most consumers, the most important part of finding the right mortgage is convincing themselves they have found the “lowest” interest rate. This is understandable, as the interest rate is certainly is an important component of the mortgage. Obviously the interest rate is one important part of the mortgage; however, how does one go about accomplishing achieving their goal of funding the “lowest” rate? There are a few things that someone refinancing or purchasing a home needs to understand.

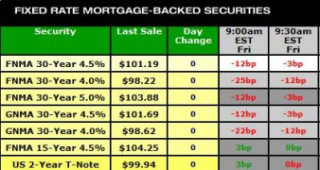

First, one needs to know that ALL mortgage rates that have low-fixed rates (FHA, VA, Rural Development and Conventional) are driven by the daily trading of mortgage-backed securities. These mortgage bonds trade on the Chicago Board of Trade. This is very similar to how stocks trade on the NASDAQ and DOW. Just like stock prices, mortgage rates change weekly, daily and even hourly; therefore, obtaining the lowest rate can be somewhat elusive.

First, one needs to know that ALL mortgage rates that have low-fixed rates (FHA, VA, Rural Development and Conventional) are driven by the daily trading of mortgage-backed securities. These mortgage bonds trade on the Chicago Board of Trade. This is very similar to how stocks trade on the NASDAQ and DOW. Just like stock prices, mortgage rates change weekly, daily and even hourly; therefore, obtaining the lowest rate can be somewhat elusive.

Suppose you lock in your rate with your lender that you decide to go with. Three weeks into the process, you are getting ready to close your loan. A day before your loan closes, the bond-market rallies and mortgage rates drop a quarter of a percent. Now all of a sudden have you really gotten the lowest interest rate? Are you going to stop the entire process, transfer your appraisal, delay your closing and switch lenders only for the same scenario to possibly happen again? What if two days after your loan closes, rates drop even further? Have you achieved the lowest rate available? The answer of course is no.

The reality is that mortgage rates are affected by many factors within the economy. If myself or anyone else for that matter knew the exact hour and day rates would be at their lowest, we would all be rich. So as you can see, achieving the “lowest” rate can be problematic; therefore, your best shot is to ask around and find someone who understands the dynamics of the mortgage market and can help you decide when to strategically lock in your interest rate. Make sure you are working with a mortgage professional that has access to live, real time, mortgage bond quotes. If the lender you are speaking with cannot explain how mortgage bonds and interest rates are moving in real time and warn you of costly intra-day price movements, you are most likely not working with a professional whom you want to entrust financing one of your largest assets, Your home.

I have seen people obsess over getting the “Lowest Rate”, only to miss the boat. Even if you were able to attain the “Lowest Rate”, this is only one piece of the puzzle. There are so many factors that you want to take into consideration other than just your interest rate. In fact, the interest rate is not the main factor one should consider when deciding how to structure their mortgage. A great rate on the wrong mortgage strategy, can literally cost you tens of thousands of dollars over the life of your loan. One must also understand the concept that it is always a balance between cost and what rate you acheive. Depending on how long a borrower plans to own their home will determine what interest rate is best for them; therefore, the lowest rate, is NOT always the best option. Many people unknowingly make an unwise decesion of paying up-front cost to get a lower rate. It is very important that you ask around and find a loan professional that takes into consideration your overall long and short term financial goals. Your mortgage is such a large component of your financial life.

Don’t entrust the process to someone who has diminished such an important transaction in your life into nothing but rates and fees. Unfortunately most loan officers have commoditized the industry and have become nothing more than order takers. Yes the interest rate and the fees you pay are important, but overlooking all other aspects of what you are looking to accomplish can cost you dearly. If you utilize your mortgage properly, it can be an integral in helping you reach your short and long term financial goals.

I encourage you to visit the CMPS Institute. This is a great place to start your search for a loan professional who approaches your mortgage from a financial planning perspective.

~DL